Bybit Card

Bybit Card — Spend and Earn Crypto on the Go

Unlock unbeatable rewards with zero hidden fees.

Apply Now

Bybit Card

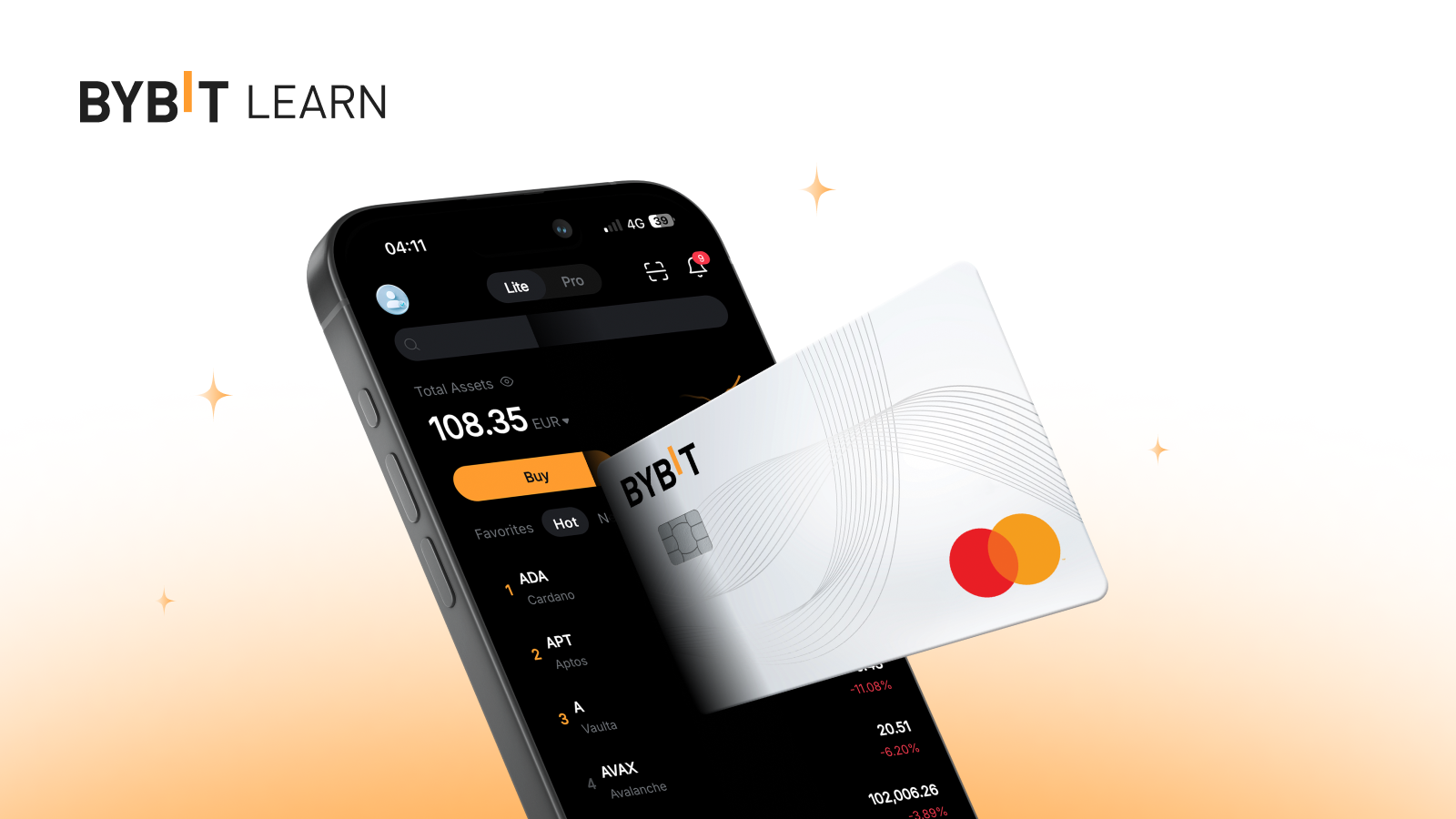

Start your 360° crypto journey with Bybit Card — the reliable and convenient way to off-ramp your crypto and spend anytime, anywhere. The Bybit Card is a Mastercard debit card that allows easy and secure access to your funds wherever and whenever you need, making it the ultimate companion for your crypto journey. Discover the potential of Bybit Card today.Total articles (20)

Q&A

Q. Who can apply for the Bybit Card?

A. To apply for the Bybit Card, you must complete Identity Verification Lv. 2. This involves providing a proof of address and a proof of identity from eligible countries issued within the last three (3) months. Bybit reserves the final decision to decline any applications upon internal evaluation of risk at Bybit’s discretion.

Q. What are the fees associated with using the Bybit Card?

A. Bybit Card fees vary by region and usage, including FX, crypto conversion, and ATM withdrawal fees, with no annual or inactivity fees.

Q: Can I set the spending limit for my Bybit Card?

A: Bybit Card spending limits are preset by region and tier and can’t be manually changed, though eligible users may request tier upgrades.

Q: How does the Bybit Card help me earn more from my crypto?

A: With Auto-Earn, your idle crypto can earn daily interest in Easy Earn's Flexible Earn products while remaining instantly available for spending with your Bybit Card.

Q. What rewards do I get when I spend with the Bybit Card?

A. You earn Rewards Points and cashback every time you spend, with higher rates and caps unlocked as your tier or VIP level increases.

.png?auto=webp&quality=40)